On Wednesday, President Biden, Vice President Harris, and the U.S. Department of Education announced a three-part plan to help working and middle-class federal student loan borrowers transition back to regular payment as pandemic-related support expires.

This plan offers targeted debt relief as part of a comprehensive effort to address the burden of growing college costs and make the student loan system more manageable for working families. Through this plan, the Department of Education will:

- Provide targeted debt relief to address the financial harms of the pandemic, fulfilling the President’s campaign commitment

- The Department of Education will provide up to $20,000 in debt cancellation to Pell Grant recipients with loans held by the Department of Education, and up to $10,000 in debt cancellation to non-Pell Grant recipients. Borrowers are eligible for this relief if their individual income is less than $125,000 ($250,000 for married couples).

- Make the student loan system more manageable for current and future borrowers by:

- Cutting monthly payments in half for undergraduate loans.

- Fixing the broken Public Service Loan Forgiveness (PSLF) program by proposing a rule that borrowers who have worked at a nonprofit, in the military, or in federal, state, tribal, or local government, receive appropriate credit toward loan forgiveness.

- Protect future students and taxpayers by reducing the cost of college and holding schools accountable when they hike up prices

- To further reduce the cost of college, the President will continue to fight to double the maximum Pell Grant and make community college free. Meanwhile, colleges have an obligation to keep prices reasonable and ensure borrowers get value for their investments, not debt they cannot afford.

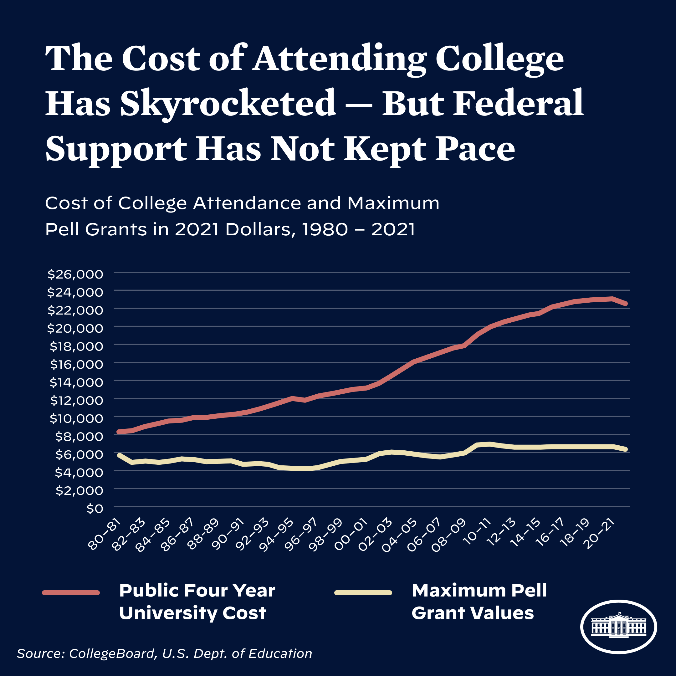

According to a fact sheet released by the White House: “Since 1980, the total cost of both four-year public and four-year private college has nearly tripled, even after accounting for inflation. Federal support has not kept up: Pell Grants once covered nearly 80 percent of the cost of a four-year public college degree for students from working families, but now only cover a third.”

Because of this, many low and middle-income students have no choice but to take out student loans if they wish to get a degree. According to a Department of Education analysis, the typical undergraduate student with loans now graduates with nearly $25,000 in debt.

“All of this means is an entire generation is now saddled with unsustainable debt in exchange for an attempt, at least, at a college degree,” President Joe Biden stated. “The burden is so heavy that even if you graduate, you may not have access to the middle-class life that the college degree once provided.”

Currently, the cumulative student loan debt is $1.6 trillion and rising for more than 45 million borrowers, causing a significant burden on America’s middle class. Middle-class borrowers struggle with high monthly payments and ballooning balances that make it harder for them to build wealth by buying homes, putting away money for retirement, and starting small businesses.

And — for the most vulnerable borrowers — the effects of debt are even more crushing as nearly one-third of borrowers have debt but no degree, according to an analysis by the Department of Education of a recent cohort of undergraduates. The analysis found that many of these students could not complete their degrees because the cost of attendance was too high.

Additionally, about 16 percent of borrowers are in default — including nearly a third of senior citizens with student debt — which can result in the government garnishing a borrower’s wages or lowering a borrower’s credit score.

Current students with loans are eligible for this debt relief. Borrowers who are dependent students will be eligible for relief based on parental income, rather than their own income.

The White House Fact Sheet revealed that if all borrowers claim the relief they are entitled to, these actions will:

- Provide relief to up to 43 million borrowers, including canceling the full remaining balance for roughly 20 million borrowers.

- Target relief dollars to low- and middle-income borrowers. The Department of Education estimates that, among borrowers who are no longer in school, nearly 90% of relief dollars will go to those earning less than $75,000 a year. No individual making more than $125,000 or household making more than $250,000 – the top 5% of incomes in the United States – will receive relief.

- Help borrowers of all ages. The Department of Education estimates that, among borrowers who are eligible for relief, 21% are 25 years and under and 44% are aged 26-39. More than a third are borrowers age 40 and up, including 5% of borrowers who are senior citizens.

- Advance racial equity. By targeting relief to borrowers with the highest economic need, the Administration’s actions are likely to help narrow the racial wealth gap. Black students are more likely to have to borrow for school and more likely to take out larger loans. Black borrowers are twice as likely to have received Pell Grants compared to their white peers. Other borrowers of color are also more likely than their peers to receive Pell Grants. That is why an Urban Institute study found that debt forgiveness programs targeting those who received Pell Grants while in college will advance racial equity.

A Kellogg Student Loan Report explained how the student debt burden also falls disproportionately on Black borrowers: “Twenty years after first enrolling in school, the typical Black borrower who started college in the 1995-96 school year still owed 95% of their original student debt.”

To ensure a smooth transition to repayment and prevent unnecessary defaults, the pause on federal student loan repayment will be extended one final time through December 31, 2022. Borrowers should expect to resume payment in January 2023.

The Department of Education will be setting up a simple application process for borrowers to claim relief. The application will be available no later than when the pause on federal student loan repayments terminates at the end of the year. Nearly 8 million borrowers may be eligible to receive relief automatically because their relevant income data is already available to the Department.

Because of the American Rescue Plan, this debt relief will not be treated as taxable income for federal income tax purposes.

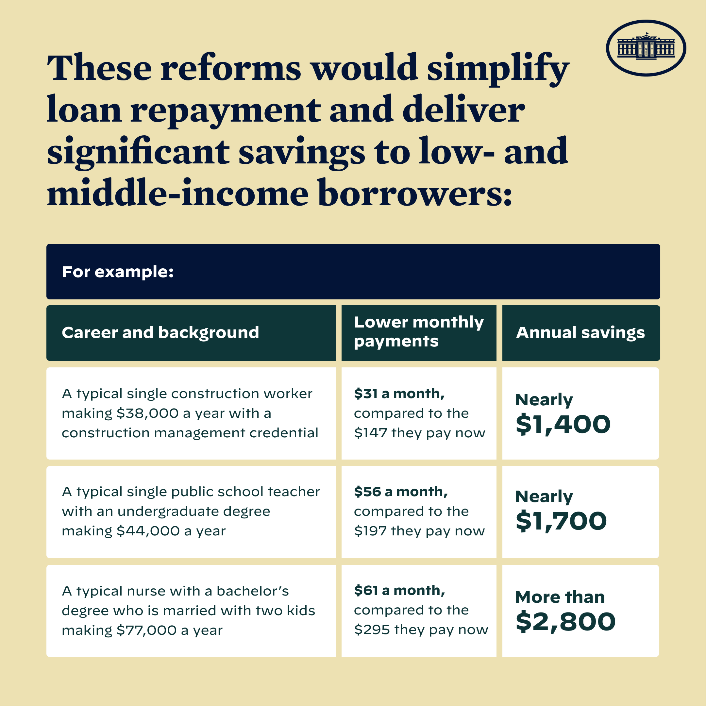

Additionally, The Administration will be reforming student loan repayment plans so both current and future low- and middle-income borrowers will have smaller and more manageable monthly payments.

The Department of Education has proposed a rule to do the following:

- For undergraduate loans, cut in half the amount that borrowers have to pay each month from 10% to 5% of discretionary income.

- Raise the amount of income that is considered non-discretionary income and therefore is protected from repayment, guaranteeing that no borrower earning under 225% of the federal poverty level—about the annual equivalent of a $15 minimum wage for a single borrower—will have to make a monthly payment.

- Forgive loan balances after 10 years of payments, instead of 20 years, for borrowers with original loan balances of $12,000 or less. The Department of Education estimates that this reform will allow nearly all community college borrowers to be debt-free within 10 years.

- Cover the borrower’s unpaid monthly interest, so that, unlike other existing income-driven repayment plans, no borrower’s loan balance will grow as long as they make their monthly payments—even when that monthly payment is $0 because their income is low.

For each of these borrowers, their balances would not grow as long as they are making their monthly payments, and their remaining debt would be forgiven after they make the required number of qualifying payments.